Regenerative Finance or ReFi, is an alternative financial system that is focused on using monetary gains to make a positive financial impact on the world. Cryptocurrency projects use the system to promote and restore sustainability and resilience by investing money earned from token sales or funds raised as capital in environmental, social, and financial causes that require much-needed attention.

One of the main criticisms aimed at traditional finance (TradeFi) has been that it prioritizes short-term profits over long-term sustainability.

Concept Of Regenerative Finance

The concept of ReFi was first coined by economist John Fullerton, who in his 2015 research paper titled “Regenerative Capitalism” stated that the traditional capitalistic model fails to prevent the negative impact it causes on the environment and society in general.

He encouraged the exploration of a new form of capitalism powered by “regenerative economics” that could produce long-lasting social and economic vitality for the global population. Here are a few ways in which ReFi is being implemented to recover and improve the negative impacts of traditional capitalism:

Climate Initiatives:

One major fault pointed out by environmentalists regarding proof-of-work (PoW) blockchains like Bitcoin is its negative impact on the climate. They say the excess energy used by Bitcoin mining operations is responsible for emitting greenhouse gases that are warming the planet.

Since the concern started to rise, a number of PoW chains adopted the more energy-efficient proof-of-stake (PoS) consensus. In 2022, Ethereum (ETH), the second-largest blockchain by market capitalization, switched from PoW to PoS. Most modern crypto projects are focused on reducing their carbon emissions and have introduced community-led initiatives to fight climate change.

Some companies even use ReFi to implement regenerative financial solutions, such as assisting other firms in investing in carbon credits, incentivizing regenerative land use, and creating platforms to organize climate initiatives.

Preservation of Culture:

Blockchain and distributed ledger technology are known for their immutable nature. Regenerative finance projects that are involved with preserving cultural heritage and historical records use non-fungible tokens (NFTs) to create verifiable and immutable records of these artifacts on the blockchain. This way, ReFi ensures that historically important subjects cannot be tampered with as the blockchain locks them into place

What is a Regenerative Finance Company?

Both for-profit and non-profit crypto companies are included in regenerative finance (ReFi), as well as decentralized autonomous organizations (DAO) that govern crypto token projects.

These companies primarily develop blockchain-based solutions that focus on ensuring the planet’s sustainability. The firms can include carbon credit trading platforms, DAOs that raise capital for funding local environmental protection efforts, and companies that mint NFTs to preserve cultural heritage and historical records on the blockchain.

ReFi firms typically issue cryptocurrencies, which are sold through exchanges, to raise funds for their various sustainability-oriented initiatives. These projects also pay dividends to users who have invested in the project by becoming a part of the DAO or have purchased the tokens themselves.

Discover more : What is Pre-Market Trading, and How Does it Work?

How is ReFi Different From DeFi?

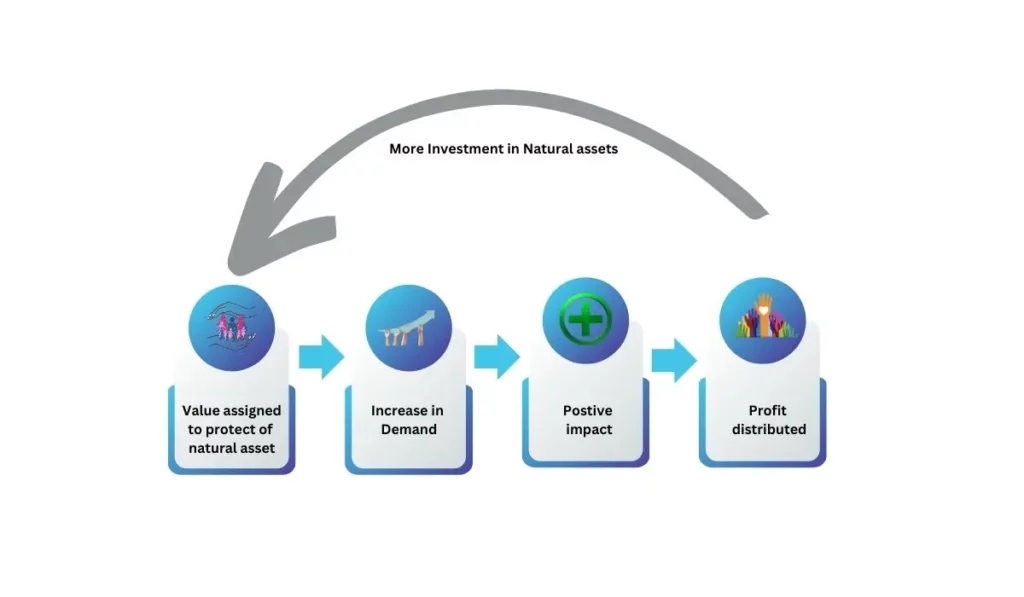

Regenerative finance (ReFi) projects are focused on using their blockchain-based platforms and crypto tokens to invest in initiatives that are focused on protecting the environment and mitigating climate change. They raise capital with the intention of reinvesting them to make a positive financial impact on the world.

Meanwhile, decentralized finance (DeFi) refers to blockchain-based financial services, such as trading, lending, borrowing, storing, and purchasing of crypto assets via decentralized platforms that are governed by decentralized autonomous organizations (DAOs).

Final Thoughts

Regenerative finance (ReFi) is similar to Environmental, Social, and Governance (ESG) investing, but utilizes a more direct and flexible approach to making impactful decisions. By basing their activities on crypto projects, ReFi companies can generate capital that can be directed towards environmentally and socially sustainable investments, also ensuring that the profits are put to better use.