Nvidia, the tech industry’s leader in the race for artificial intelligence-powered computing, released its second-quarter earnings report on Wednesday that has blown away expectations as demand for AI processors is in full force.

Chip Giant Nvidia Records All-Time-High Profits In Q2 2023

The graphics chip giant reported revenue of $13.51 billion – jumping 101% from last year, while adjusted earnings in the second quarter ended July 30 came in at $2.70 per share – up by a stunning 429% from last year.

This is after Bloomberg analysts projected Nvidia’s revenue to come in at $11.04 billion with a total of $2.07 per share in earnings.

Nvidia’s shares soared close to 9% after a revenue guidance issued by the company said that it expects sales revenue of $16 billion (plus or minus 2%) for the current quarter ending in October. The numbers far outpaced Wall Street’s forecast of the chip manufacturer generating $12.5 billion from sales in Q3 2022.

The Santa Clara, California-based company’s shares hit a record-high valuation of $515 per share during after-hours trading on Wednesday.

“A new computing era has begun”, proclaimed CEO Jensen Huang in a statement after releasing Nvidia’s earnings report. The founder pointed out that companies worldwide are transitioning from “general-purpose” to “accelerated computing” and generative AI”.

Huang also stated that during the last quarter, major cloud service providers partnered with Nvidia to implement its H100 super chip infrastructure to develop AI programs and adopt the generative AI technology in every possible industry.

The company returned $3.8 billion from 7.5 million shares to its shareholders in the quarter. The shares were repurchased by the chip designer for $3.28 billion and cash dividends.

At the end of the quarter, Nvidia reported that it had $3.95 billion remaining under its share repurchase authorization.

Nvidia also revealed in its earnings report that on August 21, its board of directors approved an additional $25 billion in stock buybacks after its results in the last quarter blew past projections.

The company will continue to repurchase shares this fiscal year and has also assigned the date for its next quarterly cash dividend payment of $0.04 per share to all shareholders for September 28, 2023.

Read More: Bitcoin ATM Network ByteFederal Officially Launches In Australia

In 2023, Nvidia Became The First Semiconductor Business To Hit The $1 Trillion Mark

Founded in 1993, Nvidia started off as a business making graphics chips for video games and personal computers, becoming one of the biggest players in the sector.

The company has fully embraced artificial intelligence technology, successfully transitioning its business model to dominate the generative AI market.

Nvidia produces what’s called the ‘accelerators’. These are chips that help train AI programs by supplying them with publicly available data sets. The semiconductor behemoth is way ahead of its competition when it comes to upgrading its hardware and software, tempting tech giants such as Amazon, Google, and Microsoft to get their hands on as many chips as Nvidia can supply.

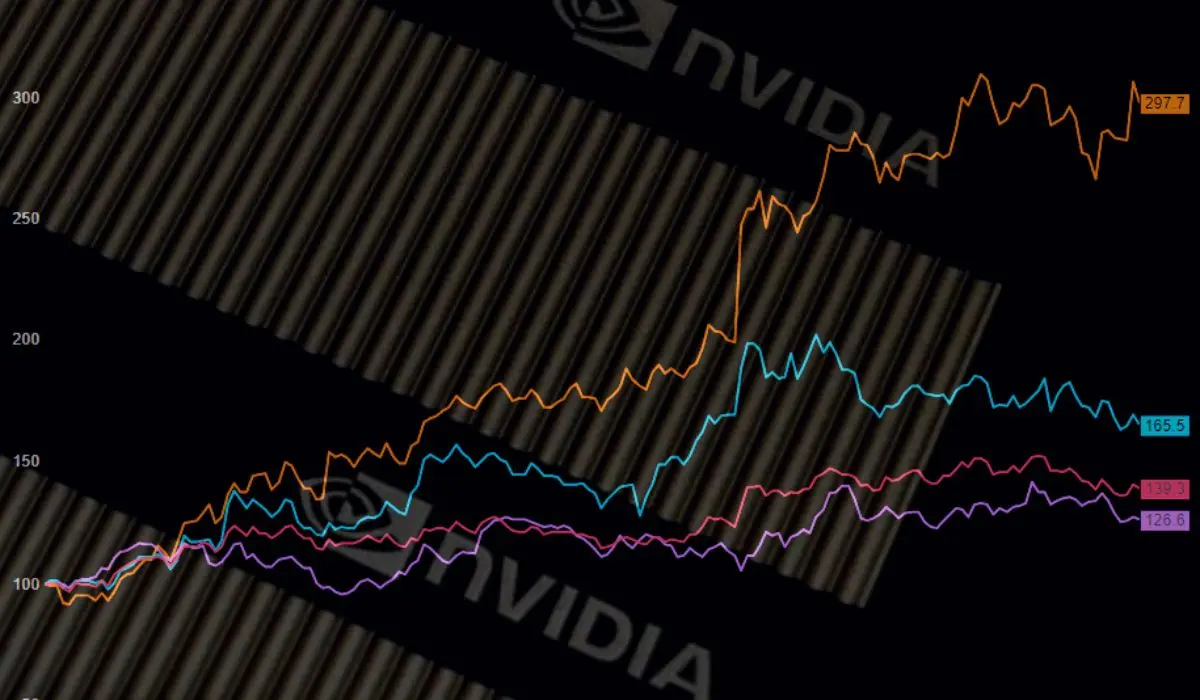

In May, Nvidia became the first semiconductor company to reach a $1 trillion market valuation after posting a strong Q1 earnings performance. The company does not operate its own manufacturing unit, instead relies on Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. to supply the chips.

However, there were concerns that the supply chain crisis could hamper Nvidia’s sales in the current quarter, but the latest earnings report bushed off all the doubts.

The most lucrative business for the company in the last quarter was its division that supplies chips to data centers, which generated $10.3 billion in sales, topping a forecast of $7.98 billion.

Meanwhile, revenues for the gaming chip section were $2.49 billion, far exceeding the $2.38 billion estimate, and the automotive-related chip-making unit brought home $253 million.

At the time of writing, NVIDIA Corp is trading at $471.16 – rising 3.17%.

Read More: Smartphone Chip Designer Arm Files For Nasdaq Listing