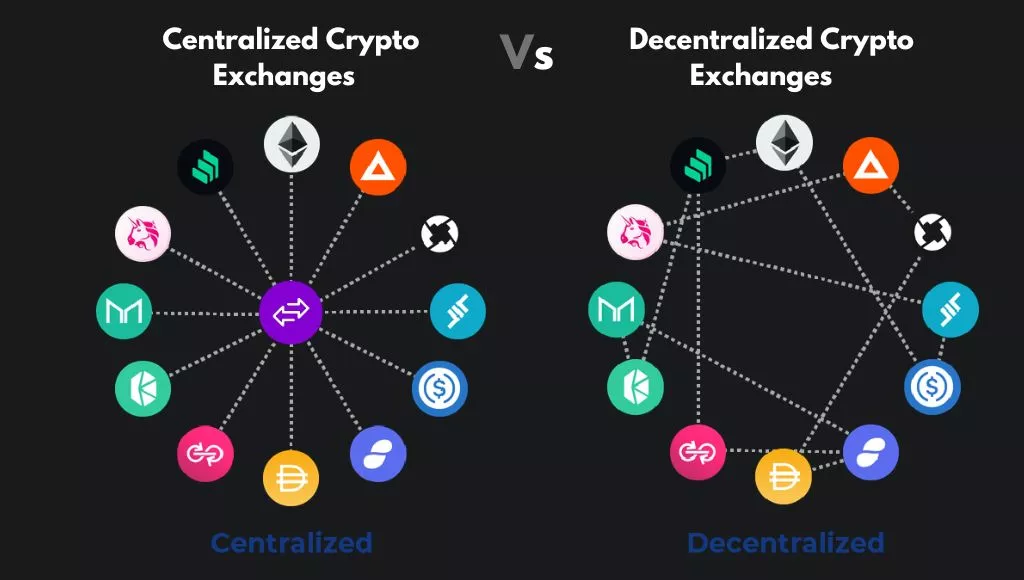

If you are planning to invest in cryptocurrencies, your first port of call will probably be an exchange. For most traders, their point of entry is a centralized crypto exchange (CEX) and there are several popular centralized platforms where crypto trading can take place, such as Binance, Coinbase, and Kraken to name a few.

However, for those among us who are suspicious about the centralized management of CEXs, there are decentralized exchanges (DEXs) on offer that have gained massive popularity over the last five years. Platforms such as Uniswap and Pancakeswap allow traders to directly hold their own assets, whereas CEXs manage assets on your behalf.

Let us take a detailed look at the difference between the two.

What Is A Centralized Crypto Exchange?

Centralized exchanges are the most popular and regularly used crypto trading platforms. As the name suggests, CEXs are controlled by a central entity that acts as an intermediary between the buyer and seller.

A CEX stores digital assets on behalf of its clients and facilitates crypto trading processes according to its terms and conditions, which the trader must first accept to use the various services offered.

Clients are typically required to undergo Know-Your-Customer (KYC) procedures to verify their identities. This is done to help curb illicit activities, such as money laundering and terrorist financing, from taking place on the platforms. This is also performed to comply with regulatory requirements.

The steps to register an account involve submitting identity verification documents and waiting for a confirmation from the platform. Users are permitted to fund their accounts and commence trading once the KYC procedures are completed.

CEXs conduct crypto trading by relying heavily on order book-matching technology. The system helps identify matches between buyer and seller orders to facilitate trades. Many centralized platforms also utilize market makers to provide liquidity for listed cryptocurrencies to ensure a competitive spread.

Related: How To Achieve Success In Token Marketing?

What Are The Advantages and Disadvantages Of Centralized Crypto Exchanges?

Advantages

- CEXs are designed to be user-friendly, allowing both beginners and experienced traders to navigate the platform, deposit, withdraw, and trade their crypto effortlessly

- Established centralized crypto exchanges support the trading of a wider range of assets. This is a boom for traders who seek to diversify their crypto portfolio

- CEXs have higher liquidity compared to DEXs, making it easier for users to purchase or sell crypto without significantly impacting its prevailing market value at low volatility. The more liquid an asset is, the easier it is for it to be exchanged.

- Centralized exchanges are owned and managed by regulated entities and are subject to rigorous regulatory oversight

Disadvantages

- Users have no control over crypto wallets on a centralized crypto exchange platform. They lack direct access to their assets, which could lead to significant losses in the event a CEX abruptly shuts down.

- Centralized exchanges are also susceptible to hacks and have lost hundreds of millions of dollars worth of cryptocurrencies in high-profile attacks over the years.

- Centralized control also makes CEXs susceptible to rug pull that can cause investors to lose all their money.

- Since they are subject to regulatory oversight, CEXs can sometimes fall prey to stringent restrictions, such as new licensing requirements and compliance regulations. This can limit their ability to support certain tokens or cater to users in certain jurisdictions.

What Is Decentralized Crypto Exchange?

Decentralized exchanges (DEXs) are crypto trading platforms that are built to top a decentralized, noncustodial blockchain protocol. These platforms primarily support direct peer-to-peer crypto transactions between users.

All transaction procedures on a DEX are controlled by self-executing blockchain-based applications known as smart contracts. This eliminates the need for intermediaries.

Another major advantage for users is that they do not have to sit through a KYC to start funding their accounts, allowing them to trade anonymously. DEXs also enable traders to maintain control over their private keys. This means users are solely responsible for the security of funds that are held in their crypto wallets.

What Are The Advantages and Disadvantages Of Decentralized Crypto Exchanges?

Advantages

- Unlike centralized exchanges, DEXs have a strong resilience to censorship and therefore do not employ KYC procedures. They allow clients to perform trades anonymously and cater to the unbanked population who lack access to traditional banking services.

- DeFi platforms like DEXs allow users to lend and borrow funds through a peer-to-peer system controlled by smart contracts.

- They can also earn a passive income by lending their assets through DeFi staking

- Since there are no intermediaries, decentralized crypto exchanges tend to have lower transaction fees compared to their centralized counterparts

- Clients have complete control over their assets

Disadvantages

- DEXs oftentimes suffer from lower liquidity levels due to their smaller user base and trading volumes. This can cause price deviations for assets, resulting in unfavorable trading outcomes

- Decentralized platforms are less user-friendly than CEXs as they require users to be familiar with blockchain technology. For instance, clients must use wallets that are compatible with the blockchain on which the DEX runs and have to manage their own private keys

- Users have to purchase the native token of the DEX in order to pay transaction fees

- Since DEXs are not controlled by a central entity, they lack compliance standards and are vulnerable to illegal activities.

- There are no customer support services to assist users during times of need